The Bear Case Has Real Teeth

If you're betting against disruption, there's ammunition.

Google processes 8.5 billion searches daily with zero customer acquisition cost. They've been training users for 25 years to type queries into a box. OpenAI needs to convince 800 million people to change their behavior. Google just needs to make search slightly better.

And we've seen this movie before. In early 2023, everyone assumed AI chatbots would quickly transform or replace search engines. The search landscape of 2024 looked oddly similar to 2023. Bing added ChatGPT—market share barely moved. DuckDuckGo pushed privacy for a decade—still under 3%. Every few years produces a new "Google killer." None of them killed Google.

Worse for the disruption thesis: AI might actually help Google. Q3 2025 search ad revenue grew 15% to $56 billion—defying predictions of decline. Google claims AI Overviews monetize at the same rate as traditional search. Ad presence in AI Overviews went from 3% in January to 40% by November. More AI, more queries, same monetization rate. The bear case writes itself.

The enterprise argument sounds even stronger. Microsoft bundles AI into Office 365. Google integrates Gemini into Workspace. Anthropic sells standalone tools. Bundling beats best-of-breed every time. Ask Slack how competing with Microsoft Teams worked out.

The incumbents have infinite cash to subsidize AI losses. OpenAI burns $8 billion annually on $20 billion revenue. Google can operate AI at zero margin indefinitely. Sometimes the giant doesn't fall.

But I'm not alone in questioning this narrative. Mark Mahaney at Evercore ISI forecasts $25 billion in ChatGPT advertising revenue by 2030. Consumer surveys show 1 in 4 Americans already prefer ChatGPT over Google for product research—and Gen Z adoption hits 85%. Meanwhile, HSBC gives Anthropic 40% of enterprise AI spending versus OpenAI's 29%, and Accenture just committed 30,000 professionals to Claude training. Google's search market share dipped below 90% for the first time in over a decade. The cracks are showing.

But They're Measuring the Wrong Battle

Here's what everyone misses: Google's "comeback" is entirely defensive. They're not creating new revenue—they're protecting $178 billion in existing search ads. That's not victory. That's managed decline.

The real question isn't "Who has the best AI model?" It's "Where do commercial intent queries happen?" Shopping, travel, product research—that's where Google's money lives. And the behavioral shift is already underway.

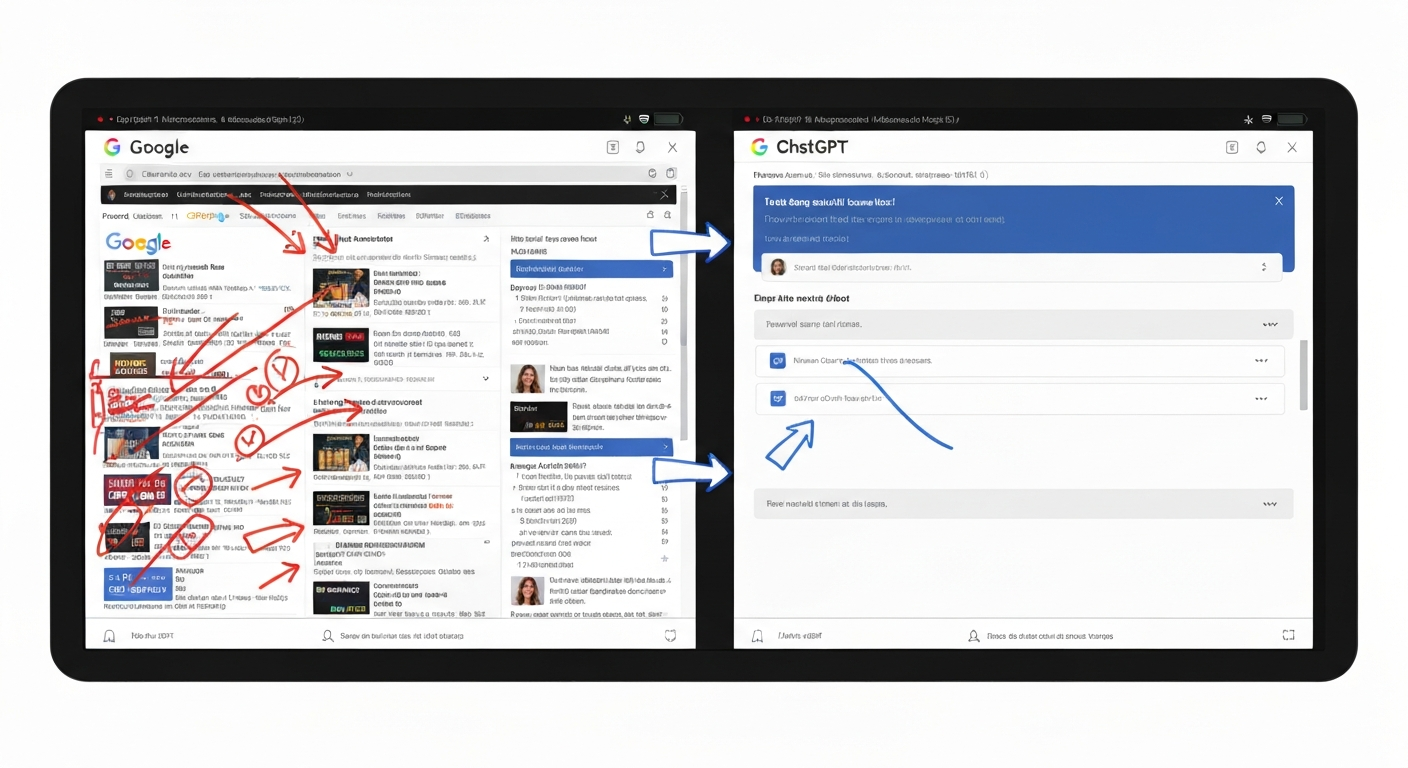

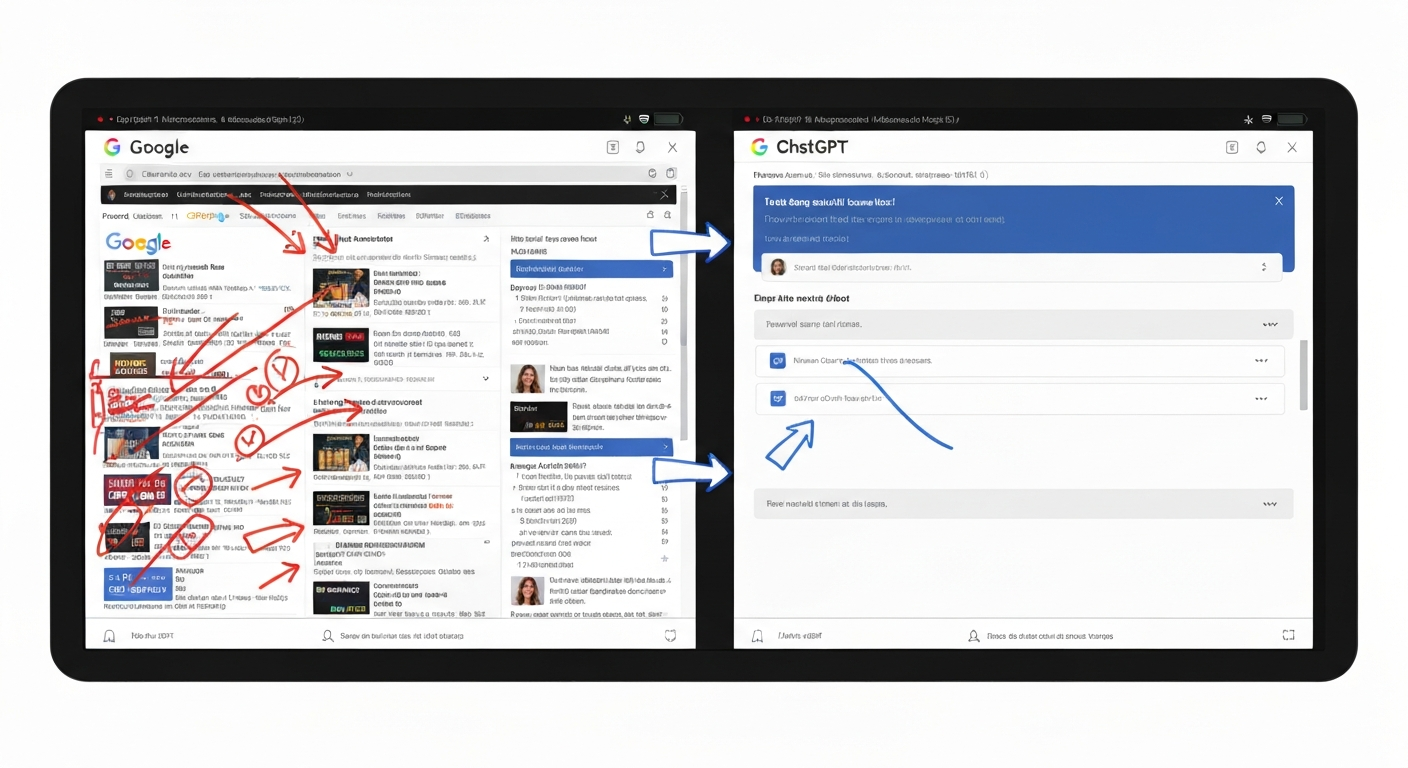

I watch normal people—not tech early adopters—researching purchases in ChatGPT instead of Google. They're tired of wading through Amazon's sponsored garbage and Google's ad-stuffed result pages. ChatGPT gives clean answers. Google gives you twelve sponsored listings for "best running shoes" followed by SEO spam.

This is the incumbent trap. Google maximized short-term revenue by making search unusable. That created the opening. The users are already moving. The ad dollars will follow.

The Game Theory is Backwards

Everyone's tracking the wrong scoreboard.

OpenAI's strength isn't their model—it's that ChatGPT became a verb. 910 million monthly users. 85% of Gen Z using it for shopping research. When Matt Britton says "search used to be the start of the shopping journey, now it begins with a conversation," he's describing OpenAI's moat. They own the consumer relationship for the AI era.

Anthropic is playing a completely different game. While everyone obsesses over ChatGPT versus Gemini in consumer chatbots, Claude quietly captured 40% of enterprise AI spending and 54% of coding automation. Fortune reports that junior developers using Claude Code now produce senior-level work, onboarding in weeks instead of months. Anthropic's own engineers use Claude for 60% of their tasks, reporting 50% productivity gains.

This isn't about who has the best benchmark scores. It's about who's remaking how work actually gets done.

I've spent 8-10 hours daily with Claude Code for months. It's not a tool—it's a transformation. I haven't opened a Word document or spreadsheet in weeks. I don't need them anymore—except to send things to people who live in the past. When AI handles the grunt work, you realize how much time you wasted on tasks that didn't require human creativity. Knowledge work is about to look very different.

Google can subsidize AI forever. But subsidizing decline is still decline.

The Personal Evidence

My entire workflow has changed.

I used to Google and work in spreadsheets and documents like everyone else. Now I run agent debates, deep research pipelines, and multi-step analysis that would have taken days. I only create documents when I have to send something to people living in the past.

Claude Code isn't a chatbot. It's the smartest coworker you'll ever have. It handles the tedious tasks—but more importantly, it pushes my thinking farther than it's ever gone before.

This isn't unique to me. Enterprise customers are already voting with their wallets. Anthropic's revenue exploded from $1 billion to $7 billion annualized in ten months. That's not pilot program money—that's production deployment budget. Accenture just committed 30,000 professionals to Claude training. Microsoft is integrating Claude into Office 365 for 100 million users.

The productivity revolution isn't coming. It's here. Most people just haven't noticed yet.

The Data Backs It Up

The numbers tell a different story than the stock prices:

OpenAI's consumer conversion crisis: 800 million weekly users, but only 5% pay for subscriptions. Their advertising pivot isn't desperation—it's inevitable. If OpenAI does ads well, users will eat them up. Imagine asking "what's the best running shoe for my flat feet?" and getting a genuinely helpful recommendation instead of twelve sponsored listings and SEO garbage. That's not advertising people tolerate—that's advertising people actually want.

Anthropic's quiet dominance: 54% of coding automation market while everyone argues about ChatGPT versus Gemini. Developers have already chosen. They're building the tools that knowledge workers will use tomorrow.

Google's defensive spending: They're not investing in AI growth—they're investing in AI preservation. Protect the search monopoly, integrate Gemini into existing products, maintain the status quo. That's not innovation. That's death by a thousand cuts.

Everyone thought Google had outplayed the innovator's dilemma. They were the disruptor that survived, the exception to the rule. No. They're in the middle of it right now.

What the Smart Money Says

Prediction markets tell an interesting story. Anthropic has a 72% chance of going public before OpenAI, despite starting later. That suggests confidence in their business model versus OpenAI's cash burn trajectory.

But here's my contrarian bet: OpenAI's valuation is too low. Google's search ads generated $178 billion last year. If OpenAI captures even 10% of that with better-targeted AI advertising, it's an $18 billion business. At an $830 billion valuation, that's underpriced—if the advertising model works.

I'm watching two specific metrics: OpenAI's ad revenue 6-12 months after launch, and enterprise AI spending allocation between Anthropic versus bundled Microsoft/Google solutions. Those numbers will tell us whether disruption or integration wins.

The Bottom Line

Google is defending. OpenAI and Anthropic are building.

Google's AI comeback is about protecting $178 billion in search ads. That's not a growth story—it's a holding action. And holding actions lose to focused attackers.

Here's what I see: OpenAI wins consumer if they stay focused. Anthropic is already a death star coming for Microsoft's productivity moat. And Google? They're defending a search business that users increasingly hate.

Google's rise could reverse as quickly as it happened. Not because their AI is bad, but because they're optimizing for a world that's already disappearing.

P.S. This analysis was researched and structured using Claude Code and Pattern Lab techniques—proof that the AI productivity revolution is already here for those paying attention.