My Predictions

I'm putting my credibility on the line. Pattern Lab tracks every prediction.

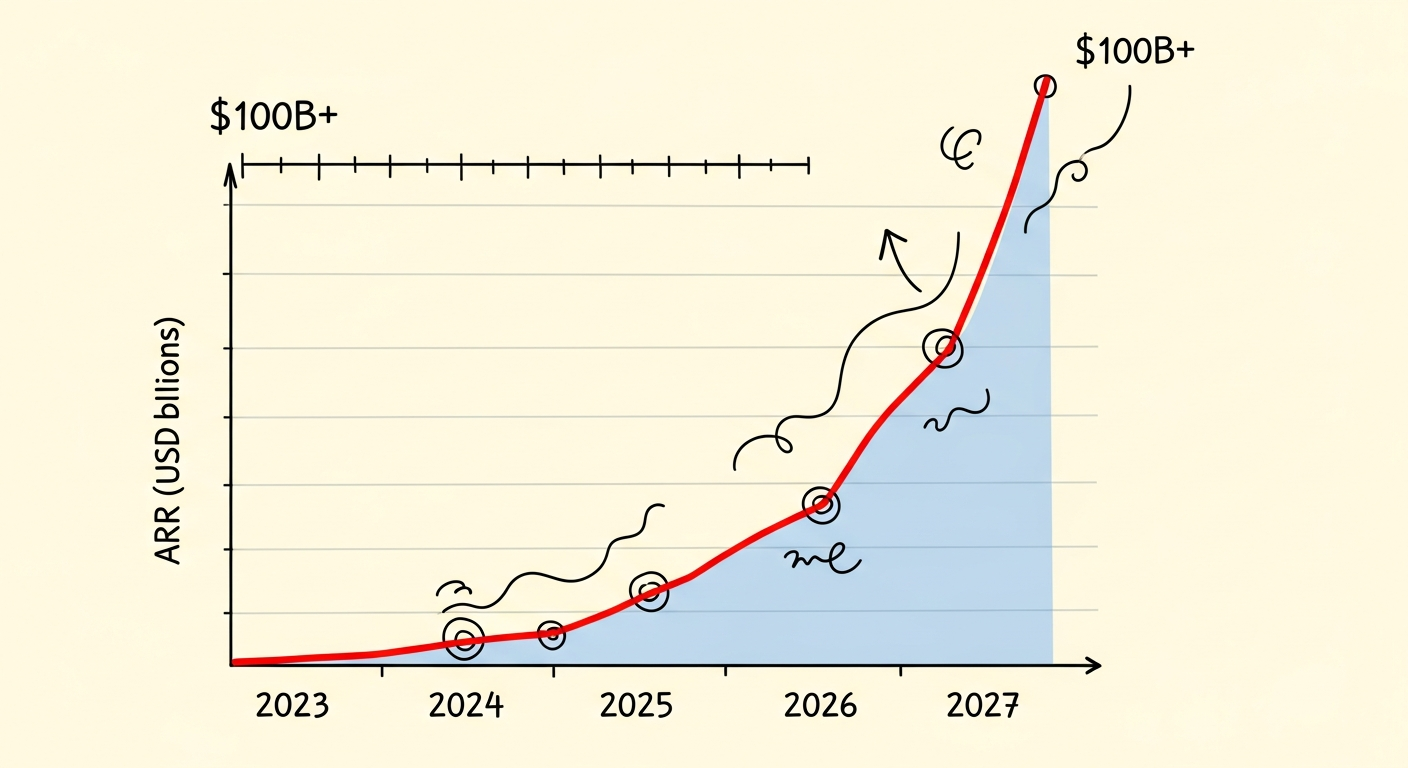

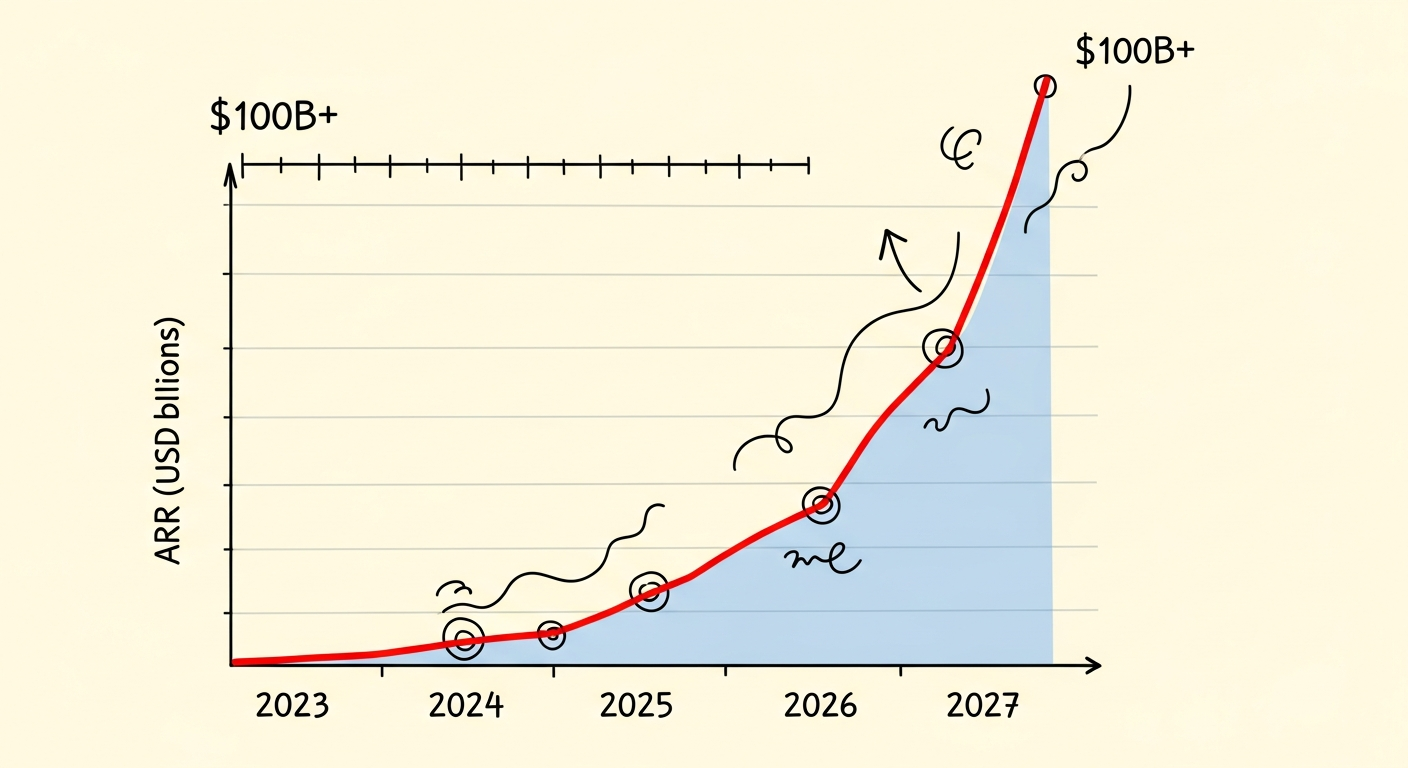

Prediction 1 (High confidence): AI company revenue will exceed $100 billion ARR by December 31, 2026.

Current state: OpenAI is at $20B+, Anthropic at $9B+, plus Google, Microsoft, and others. We're already approaching $40-50B combined. Doubling in 12 months is aggressive but achievable given current growth curves.

Prediction 2 (Medium confidence): Enterprise AI adoption will exceed 50% seeing measurable ROI by March 2027.

Current state: MIT's 2025 study found only 5% of enterprises seeing P&L impact. But that study measured pilots within 6 months of deployment. The enterprise tooling launching now (Azure Foundry, Vertex AI) will flip this stat. I'm betting on the AWS 2010 moment happening in 2026.

The Bear Case

Let me steelman the skeptics. The numbers look terrifying.

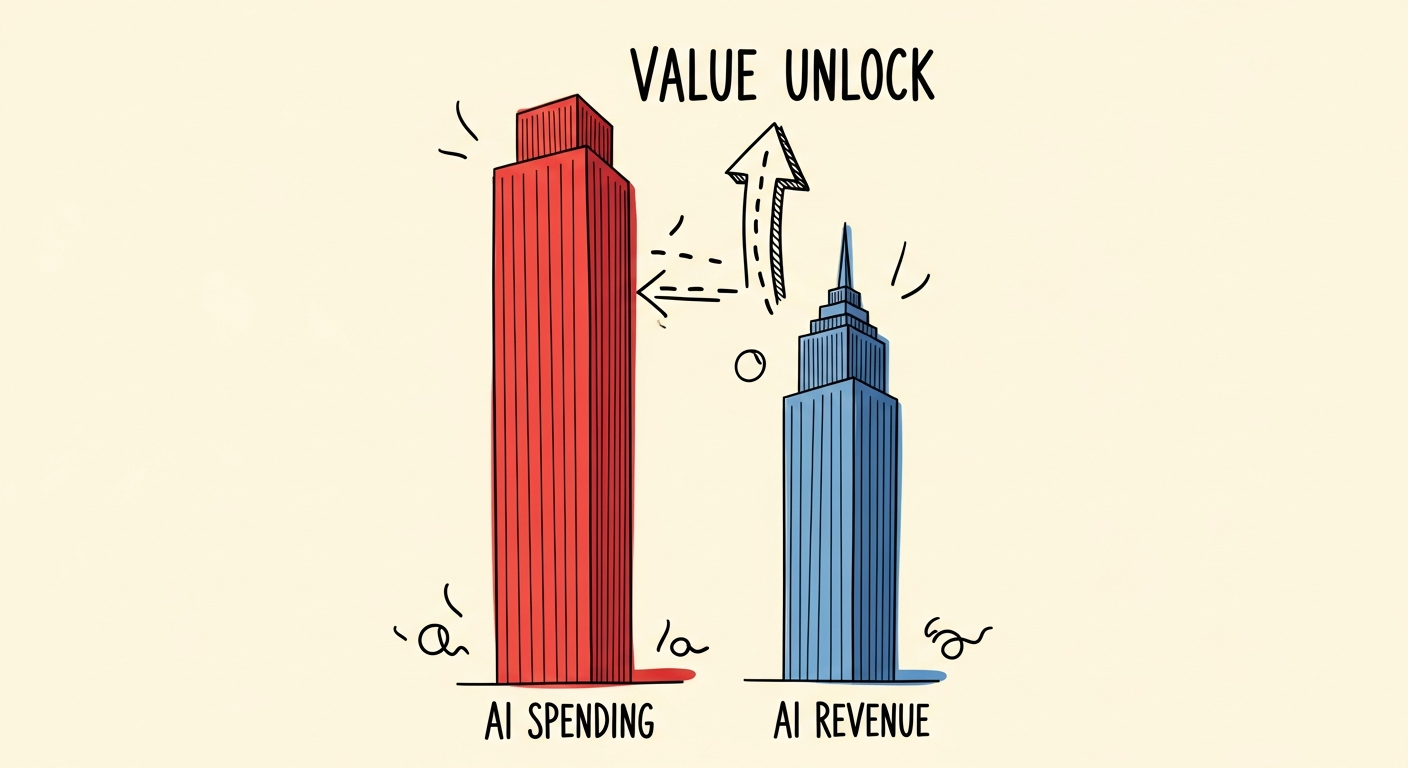

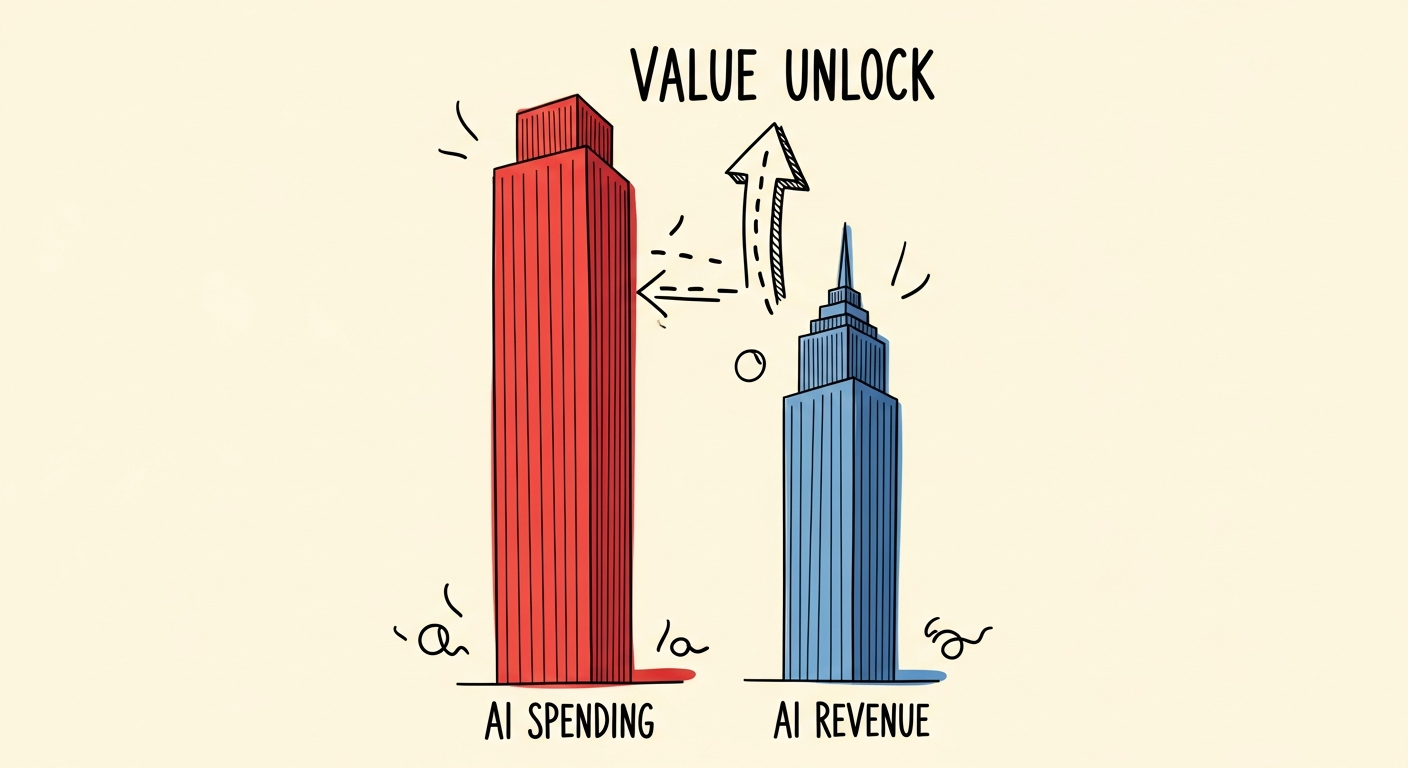

The spending: $290 billion on AI infrastructure in 2024. $320-350 billion projected for 2025 from hyperscalers alone. Over $500 billion annually by 2027—the GDP of Singapore.

The revenue: OpenAI hit $20 billion ARR by year-end 2025. Anthropic reached $9 billion. Claude Code alone: $1 billion run-rate within six months of launch.

Revenue is growing fast. Spending is growing faster. That gap makes investors nervous.

The funding scramble: OpenAI just raised $50 billion from the Gulf. When you've exhausted Silicon Valley and are pitching sovereign wealth funds, it looks like trying to stick the sheiks with the bag.

The echoes of history:

- Dot-com (2000): NASDAQ fell 78%, took 15 years to recover. Lucent dropped 97%. Intel 84%. Cisco 88%.

- But Amazon? $5 in 2001. Over $200 today. Sometimes the bubble pops and the real companies win anyway.

- Railroads (1870s-80s): Built America. Crashed repeatedly. Panics of 1873 and 1893. Investors got crushed. The country got transformed.

The voices of concern:

- Sam Altman: "Are investors overexcited about AI? My opinion is yes."

- Ray Dalio: "Very similar to the dot-com bubble."

- Sundar Pichai: "Some irrationality... no company will be immune."

- MIT: 95% of enterprises see zero P&L impact from GenAI despite $30-40 billion invested.

Deutsche Bank says the U.S. might be in recession without AI spending. The OECD calls it a "key downside risk."

If you're bearish, there's ammunition.

Why The Ratio Is Wrong

The bubble analysts measure AI company revenue against AI infrastructure spending. That's like measuring railroad profits against the value of connecting a continent.

Railroads built America. Commerce, migration, industrialization—all rode the rails. Many railroad investors got wiped out. But the value wasn't captured by the builders. It was captured by everyone who used the tracks.

The dot-com boom laid fiber. Telecom stocks crashed. Lucent and Nortel went to zero. But that fiber enabled Netflix, Zoom, cloud computing, the entire modern internet. The infrastructure enabled the winners, even as the builders lost.

AI will follow the same pattern. The metric that matters isn't Anthropic's revenue. It's the productivity gains across every person using the technology.

McKinsey estimates generative AI could add $2.6 to $4.4 trillion annually to the global economy. That's not AI company revenue. That's value unlocked.

Jensen Huang put it plainly: "This is the largest infrastructure build-out in human history."

The Enterprise Problem

That MIT stat about 95% seeing no ROI? It's real. But it's describing a specific phenomenon.

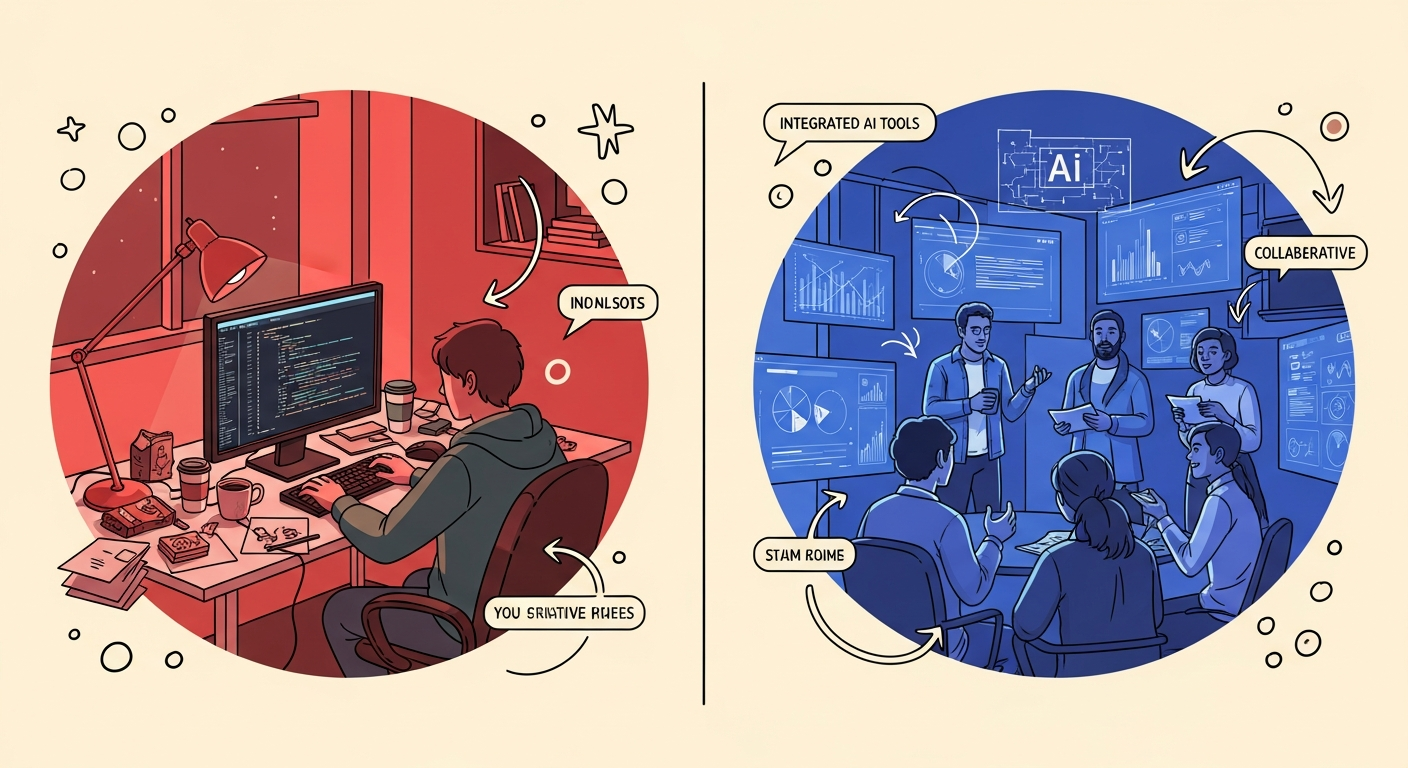

We've been in the era of single-player AI.

The people getting value are motivated individuals willing to spend hours learning tools, comfortable with ambiguity, able to figure it out without a manual.

That's me. That's the early adopters. We're a small percentage of the workforce.

Organizations need something else. Consistency. Reliability. Governance. Security. They can't have every employee experimenting with different tools.

This is about to change.

Microsoft launched Foundry Agent Service: "You bring your code; we handle the rest." Autoscaling, monitoring, identity, security—all built in.

Google launched Vertex AI Agent Engine: managed agent deployment with native identity, VPC privacy, and HIPAA compliance. Enterprise-grade from day one.

2026 is the year multiplayer AI begins.

When IT teams can deploy AI agents with the same confidence they deploy cloud apps, that MIT stat flips.

This is the AWS 2010 moment. AWS launched in 2006 for developers experimenting. Revenue: $21 million. By 2010, enterprise tools made cloud accessible to regular IT teams. Today: $108 billion annually.

We're at that inflection point.

What Changed For Me

I didn't wake up able to build software. It happened in steps.

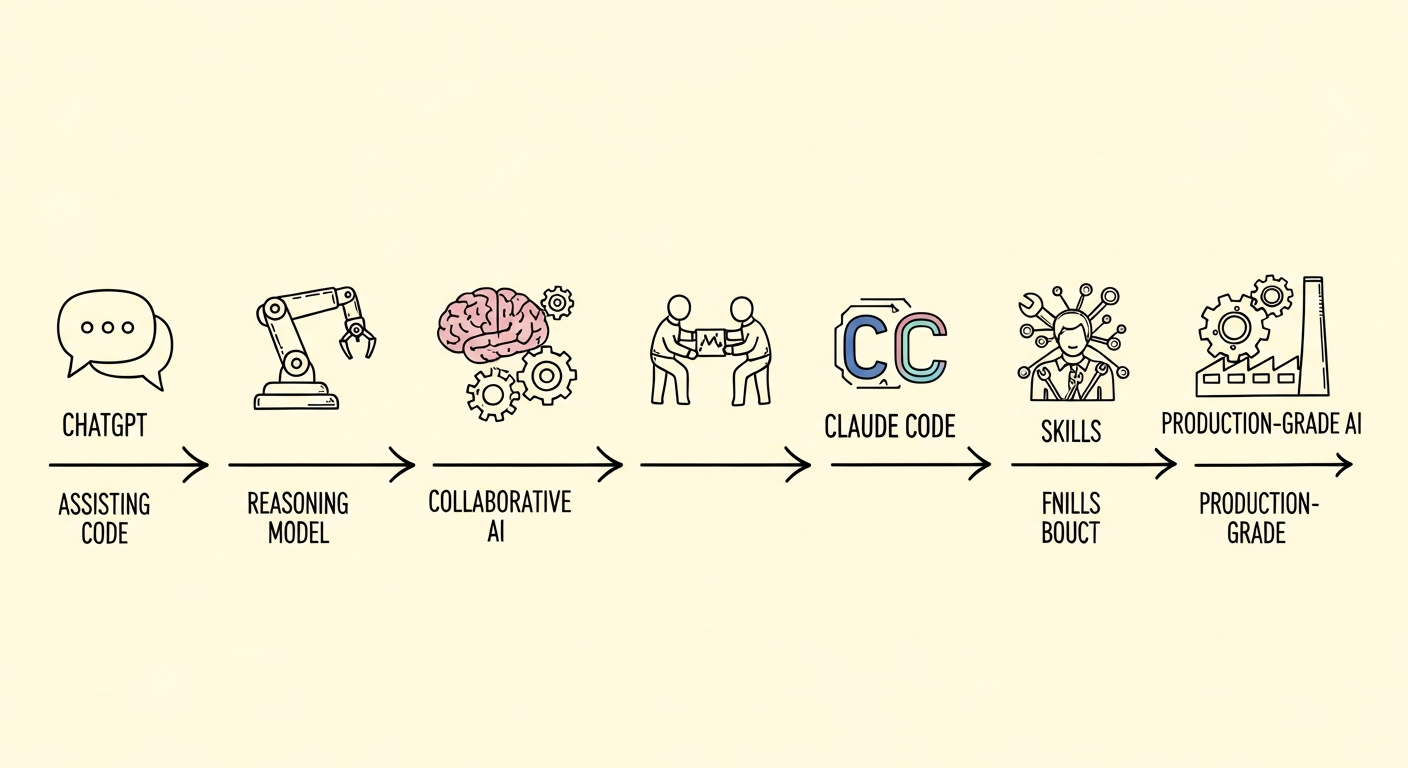

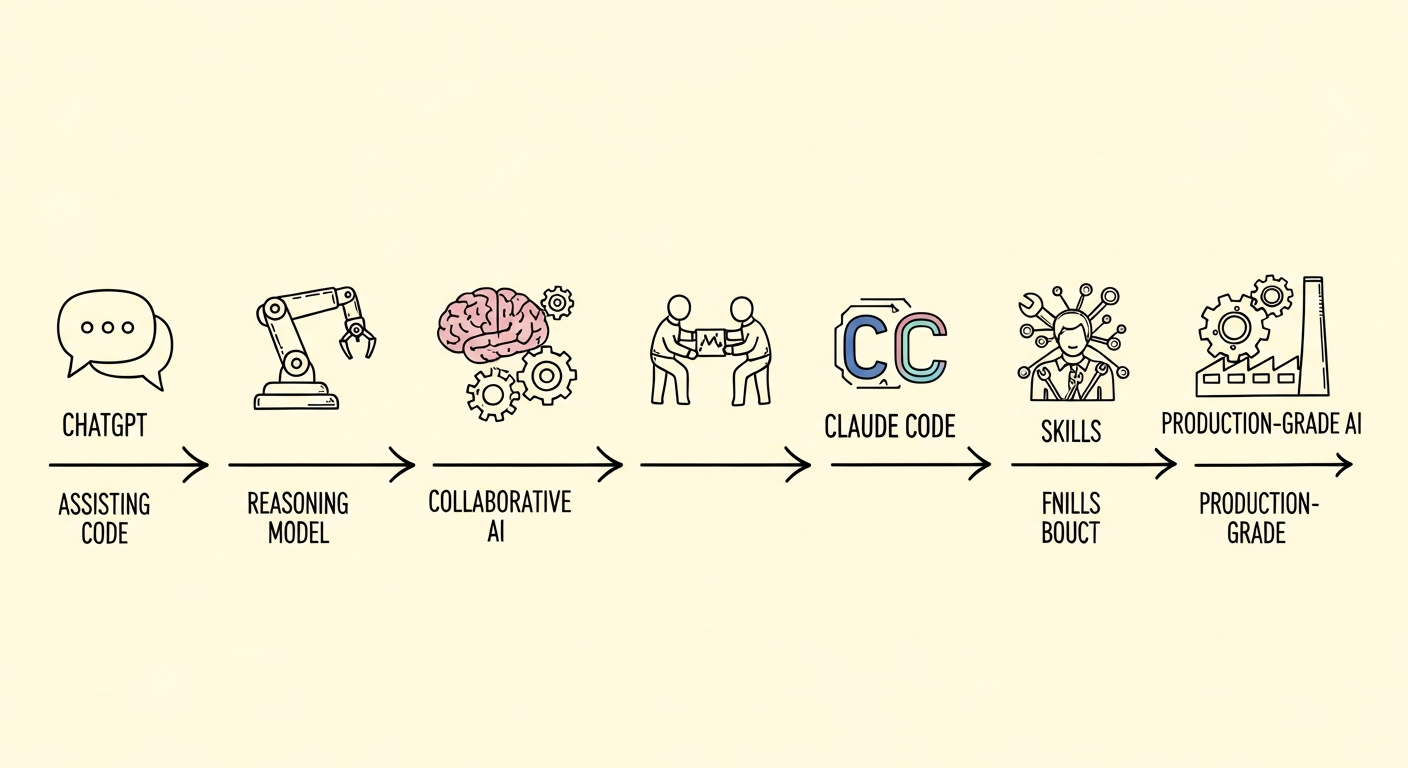

November 2022 - ChatGPT. 100 million users in two months. Good for drafts and questions. I couldn't build with it.

2023-2024 - Coding assistants emerge. Copilot, early Claude. Useful for autocomplete. I directed every step.

September 2024 - o1. The first reasoning model. The paradigm shift. Multi-step thinking. The model could actually reason.

December 2024 - o3. This blew my mind. First time an LLM kept up with me. It was thinking with me—not just taking orders. It surprised me. Made connections I missed.

May 2025 - Claude Code. $1 billion run-rate within six months. Netflix, Spotify, Salesforce signed multi-year deals.

October 2025 - Skills. Claude Code added skills—reusable best practices from senior engineers. Suddenly I wasn't just coding. I was coding like someone with 20 years of experience. Test-driven development. Proper error handling. Architecture patterns I'd never learned.

2025 - Opus 4.5. Everything changed. I could build production-grade software. Not just stuff that worked for me—stuff that worked for others. First or second try.

The difference? Claude works longer. I give it a problem, it solves sub-problems I didn't know existed. That's not assistance. That's delegation.

I'm Not An Outlier

You might think I'm an edge case. The data says otherwise.

Developer adoption: 84% use AI coding tools now (up from 44% in 2023). AI writes 46% of all code for Copilot users. Pull request time: 9.6 days to 2.4 days—4x faster.

Anthropic: $1B ARR (end 2024) → $9B (January 2026). 9x growth in 13 months. Even Microsoft engineers use Claude Code internally—despite owning GitHub Copilot.

Usage intensity: Prompt length up 4x since early 2024. Output length up 3x. Programming workloads routinely exceed 20,000 tokens.

People aren't dabbling. They're going deeper. The curve isn't flattening. It's steepening.

What The Money Says

Forget pundits. What do people betting real money think?

Polymarket has an "AI bubble burst" market. Current odds:

- ~5% by March 2026

- ~20% by December 2026

For "bubble burst" to resolve yes, three of these must happen within 90 days: Nvidia down 50%, semiconductor ETF down 40%, OpenAI or Anthropic bankruptcy, OpenAI acquired, or GPU rental prices collapse.

Translation: people with skin in the game give catastrophe an 80% chance of NOT happening.

My bet: That 20% is too high. Three of those five conditions simultaneously? That's not a correction. That's an extinction event.

And here's the thing: if Nvidia and semiconductors crashed that hard, the likeliest cause is someone found cheaper, better chips. That's not AI dying. That's AI getting cheaper. Usage wouldn't fall—it would explode.

I'm tracking this market. If I'm wrong, I'll write that article too.

Why I Don't Care About Stock Prices

I don't care if Nvidia goes up or down. I don't care about AI valuations. I don't care if investors lose money.

Why? I'm not investing in AI companies. I'm using AI.

Stocks crash or soar—my capability doesn't change. I can still build software. I can still think with a partner that keeps up with me. I can still feed myself.

The bubble question is an investor question. Wrong question for everyone else.

The right question: What can you do now that you couldn't before?

For me: everything.

The Bottom Line

The AI bubble debate measures the wrong thing.

Yes, infrastructure spending exceeds AI company revenue. That's what infrastructure buildouts look like. Railroads, electricity, fiber, cloud—every transformational technology followed this pattern. Builders often don't capture the value. Users do.

I'm a user. I was born without arms. I relied on others my whole life. Now I have arms. I build software. I think with a partner that keeps up with me. I produce in a morning what took weeks.

If Anthropic gave me more compute, I'd use it all. The demand isn't speculative. It's someone with arms for the first time, using them for everything.

The future is here. I'm living in it.

Maybe I'm a junkie. Maybe I'm a time traveler from 2027.

Either way, I'm not going back.

This article was written by talking to Claude Code running Opus 4.5. The irony is intentional.

P.S. How I Built This

For the curious—this piece was built with the tools it describes:

-

Finding the topic. Morning AI interview. Several false starts. Landed on the question I actually cared about.

-

Capturing voice. As I talked—the arms metaphor, the 8-10 hours, the time traveler framing—Claude captured exact wording.

-

Research. Historical tech waves, spending ratios, adoption curves, verified statistics. Sources I wouldn't have found alone.

-

Sharpening. Claude pushed back: "You're generalizing from n=1." "What about 95% of enterprises seeing no ROI?" Each probe strengthened the argument.

-

Antagonist review. AI agent checked facts, flagged weak claims, identified counter-arguments I'd missed.

-

Revision. Updated statistics, changed the metaphor, added the enterprise section, acknowledged my bias.

Total time: one morning.

If you're wondering whether AI capability is real—you're reading the proof.