The Bear Case Has Real Teeth

If you're betting on SaaSpocalypse, there's ammunition.

Salesforce generated over $500M from Agentforce in one quarter. ServiceNow acquired Moveworks for $2.85B. Microsoft's CEO talks openly about the "collapse of business applications"—including his own Dynamics 365. When the vendors themselves are preparing for transformation, the transformation is real.

The numbers back up the panic. SaaS revenue multiples collapsed from 18x at the pandemic peak to 5.1x today. Salesforce stock dropped 27% in 2025 despite strong fundamentals. Bloomberg, CS Disco, and Legalzoom all crashed double digits in single trading sessions this January.

Meanwhile, enterprises are cutting traditional software spending. Publicis Sapient reports a 50% reduction in legacy SaaS licenses, substituting AI tools. Forty-two percent of IT professionals believe 20-39% of current SaaS spending is pure waste.

But here's what the bears are measuring wrong.

The Real Signal: New Logo Acquisition

Everyone's obsessing over retention rates and stock prices. The real tell is simpler: are new companies still choosing Salesforce?

I know the answer because I'm living it. Last year, I built an agentic CRM for one of my companies. There's maintenance and tuning effort involved, but it's a fraction of someone's time—and the system is far more capable than anything I could buy. A metal fabrication company I invest in started building a purchase order system and realized adopting Salesforce would be more work than building their own ERP with AI.

This isn't theoretical disruption. This is a traditional manufacturing business where the build-versus-buy math actively flipped.

I'm not unique. AI-native CRMs like Clarify, Attio, and Breakcold are specifically targeting startups that would have been Salesforce's next generation of customers. The companies being born today aren't signing up for legacy SaaS. They're skipping it entirely.

Salesforce won't disclose new logo metrics anymore. The opacity itself is telling.

The Counterarguments Deserve Respect

The strongest case for legacy SaaS surviving isn't about features or switching costs. It's about the messy reality of enterprise software.

Fifteen years of custom Salesforce configurations, compliance workflows, and data migration nightmares don't disappear because AI got smarter. Oracle skeptics made similar technical arguments during the cloud transition, and Oracle is still here pulling in $50B a year. BlackBerry's defenders had sound technical arguments about enterprise security—until they didn't.

And AI companies aren't exactly proving product-market fit yet. Forty percent gross revenue retention suggests customers are churning between AI tools, not back to legacy. That's rapid iteration, not product failure—but it's not a stable business either.

I take these arguments seriously. But they describe the speed of the transition, not the direction. Enterprise complexity slows the timeline from years to decades. It doesn't change the destination.

Game Theory: The Innovator's Dilemma Plays Out

Legacy SaaS vendors face an unsolvable puzzle. They must cannibalize profitable per-seat models to build an agent future, but shareholders won't tolerate revenue decline during the transition.

Look at Salesforce's growth trajectory: 25%+ → 11.2% (FY24) → 8.7% (FY25) → guided 8-9% (FY26). That's not a growth company anymore. It's a cash cow entering managed decline.

The strategic tension is brutal. Salesforce promotes the "agentic enterprise" while protecting $37.9B in traditional SaaS revenue. Microsoft advocates for business application "collapse" while trying not to destroy Dynamics. ServiceNow spends billions on acquisitions while investors question whether they can innovate organically.

These aren't sustainable positions. You can't defend old models while building new ones.

Meanwhile, the math for new companies keeps improving. When I talk to my AI assistant about business workflows, I don't want to hop between functional silos. I want to talk to something that knows everything relevant about my company and role. Salesforce won't integrate with third-party ERP. They won't let me use better agents on their data. So I don't start with them.

System Dynamics: The Mainframe Precedent

The best historical parallel isn't the dot-com crash or Railway Mania. It's mainframes in the 1980s.

IBM collected maintenance revenue for decades after minicomputers and PCs captured new workloads. Mainframes didn't disappear—they became invisible infrastructure running critical but static systems. The action moved elsewhere.

That's the trajectory for legacy SaaS. Salesforce will keep collecting checks from their installed base. But new companies will build on different foundations: AI agents connected to commodity databases, reasoning layers that make the underlying software irrelevant, cross-functional workflows that don't respect traditional application boundaries.

The expensive part—the user interface, training, seat licenses—becomes worthless. The valuable part—data storage and processing—becomes commoditized infrastructure.

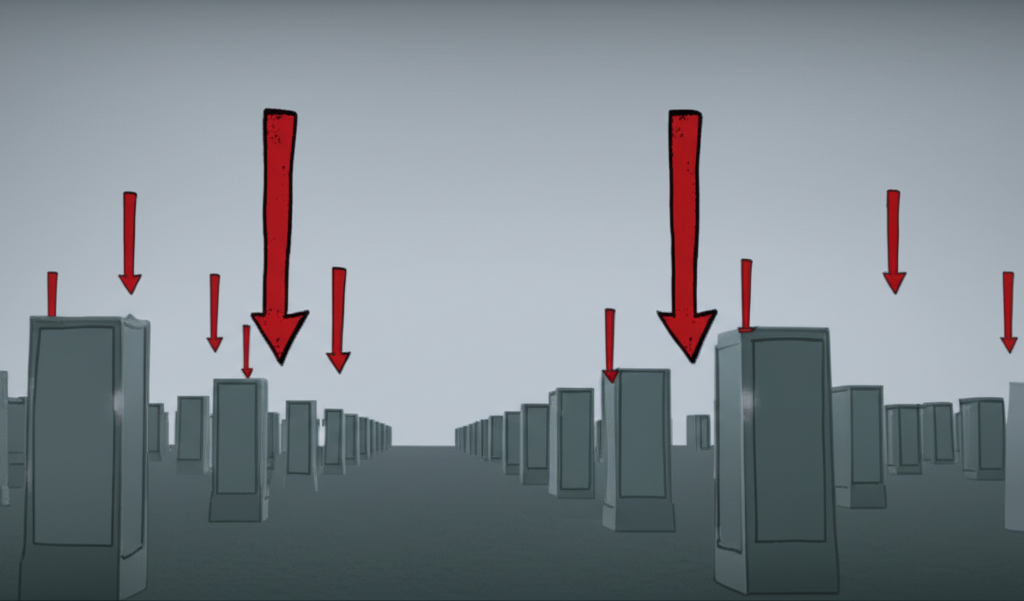

Legacy vendors will try to resist by locking down their APIs and data. But that's a trap. Lock down, and you increase the incentive for customers to migrate off your platform entirely. The value of fully agentic operations will become crystal clear in 2026 and 2027. Companies won't accept the lockdown—they'll leave. Open up, and you get commoditized. Either way, the moat drains.

The Network Effect Reversal

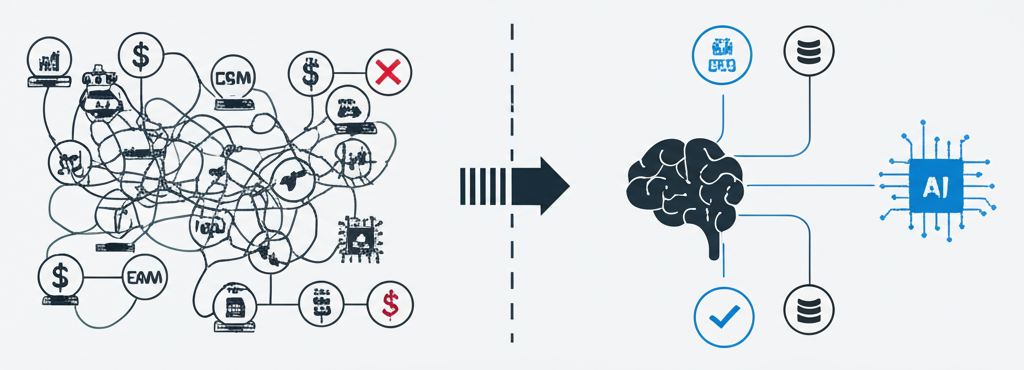

Traditional SaaS built moats through switching costs: custom configurations, user training, data lock-in. AI inverts this entirely.

When reasoning becomes the interface, data portability becomes trivial. If I can ask an AI to "migrate all contact data and interaction history to the new system," vendor lock-in evaporates. The same AI tools that threaten legacy SaaS also make migration painless.

AI-native companies show 40% gross revenue retention versus 82% for traditional SaaS. And AI companies aren't establishing SaaS-like moats either. Low retention won't improve—it's the new normal. When loyalty is dead for everyone, incumbents lose their biggest advantage.

As the VC Sam Lessin says, "software isn't a business model anymore."

Follow the Money

I spend 8-10 hours daily working with Claude on code, analysis, and writing. My companies are building custom software instead of buying off-the-shelf solutions. I'm still paying seat licenses—but the budget for compute is rising faster than the licenses, and the gap is increasing every day.

Scale that behavior across millions of knowledge workers. The revenue doesn't disappear—it shifts from application vendors to infrastructure providers. Amazon benefits whether you run Salesforce or custom AI agents. The application layer gets commoditized.

This explains ServiceNow's acquisition spree. They're not building better software—they're building bigger moats before AI levels the playing field.

The Prediction

I'll be specific: Salesforce can't sustain 10%+ revenue growth for more than one year. It's entering permanent managed decline.

The tell will be new customer metrics. Legacy SaaS companies will stop reporting new logo acquisition because the numbers will be embarrassing. Meanwhile, AI infrastructure spending grows 100%+ annually.

There are no prediction markets for this thesis yet. Polymarket and Kalshi focus on model leaderboards and sports betting, not enterprise software transformation. Someone should create a market for "Will legacy CRM/ERP vendors lose >20% market share to AI-native platforms by 2027?" I'd take that bet.

What Would Change My Mind

A return to 20%+ growth for traditional SaaS that isn't just price increases. Or legacy vendors capturing significant share of new AI spending—not selling AI features to existing customers, but actually winning AI-native deals.

Neither is happening. When building becomes easier than buying, the software industry restructures. That restructuring is underway.

The Bottom Line

The SaaSpocalypse isn't a sudden crash—it's a slow extinction event. Legacy SaaS will survive like mainframes survived: collecting maintenance revenue from installed systems while new development happens elsewhere.

The future belongs to companies that can ask intelligent questions of their data, not companies that can navigate complex user interfaces. When reasoning becomes the interface, the rest becomes infrastructure.

Legacy SaaS vendors built fortresses to protect switching costs. AI agents are building roads around them.

P.S. I wrote this collaborating with Claude, using my Pattern Lab analysis framework to structure the argument. I'm using AI tools to analyze how AI tools will reshape software markets. That's not a bug in my thesis. It's the feature.