The Bear Case Is Stronger Than I Want It to Be

The arguments against my thesis are formidable. Anyone making this bet needs to understand them cold.

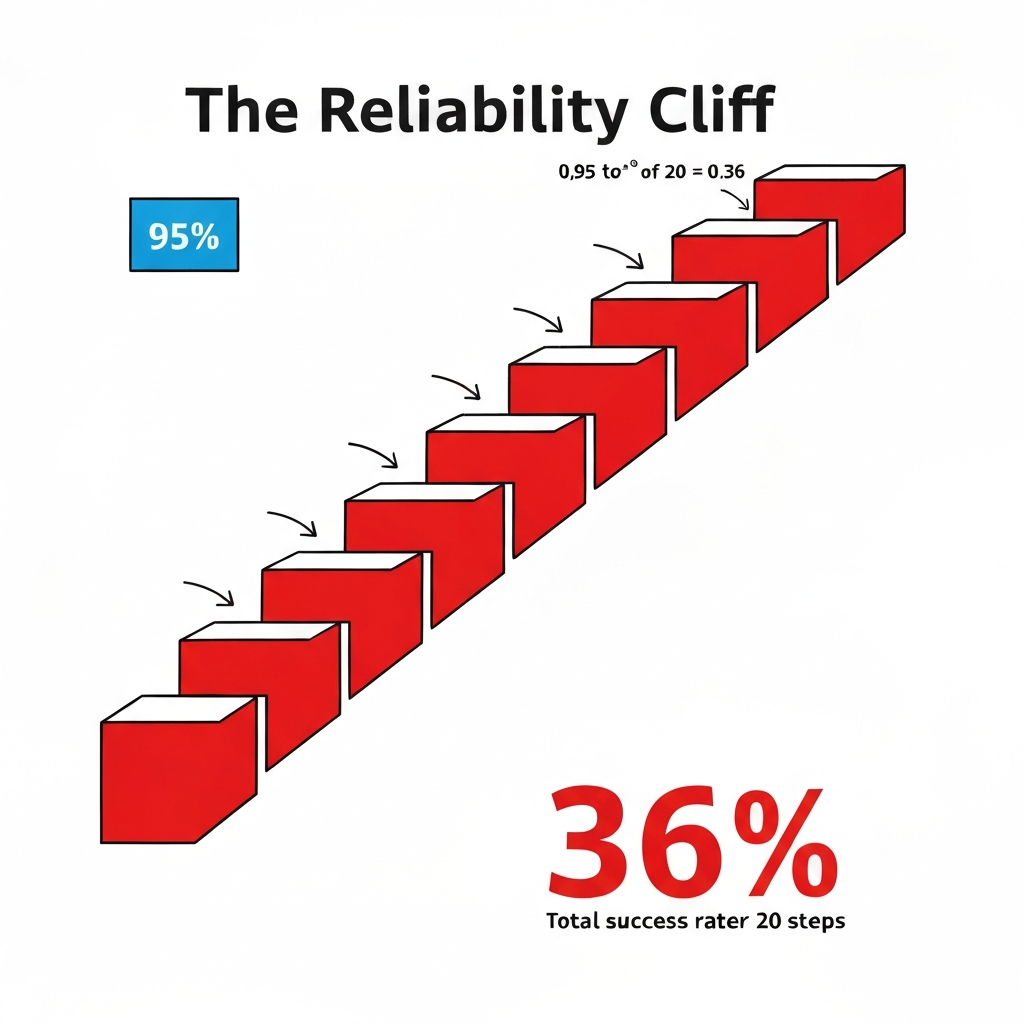

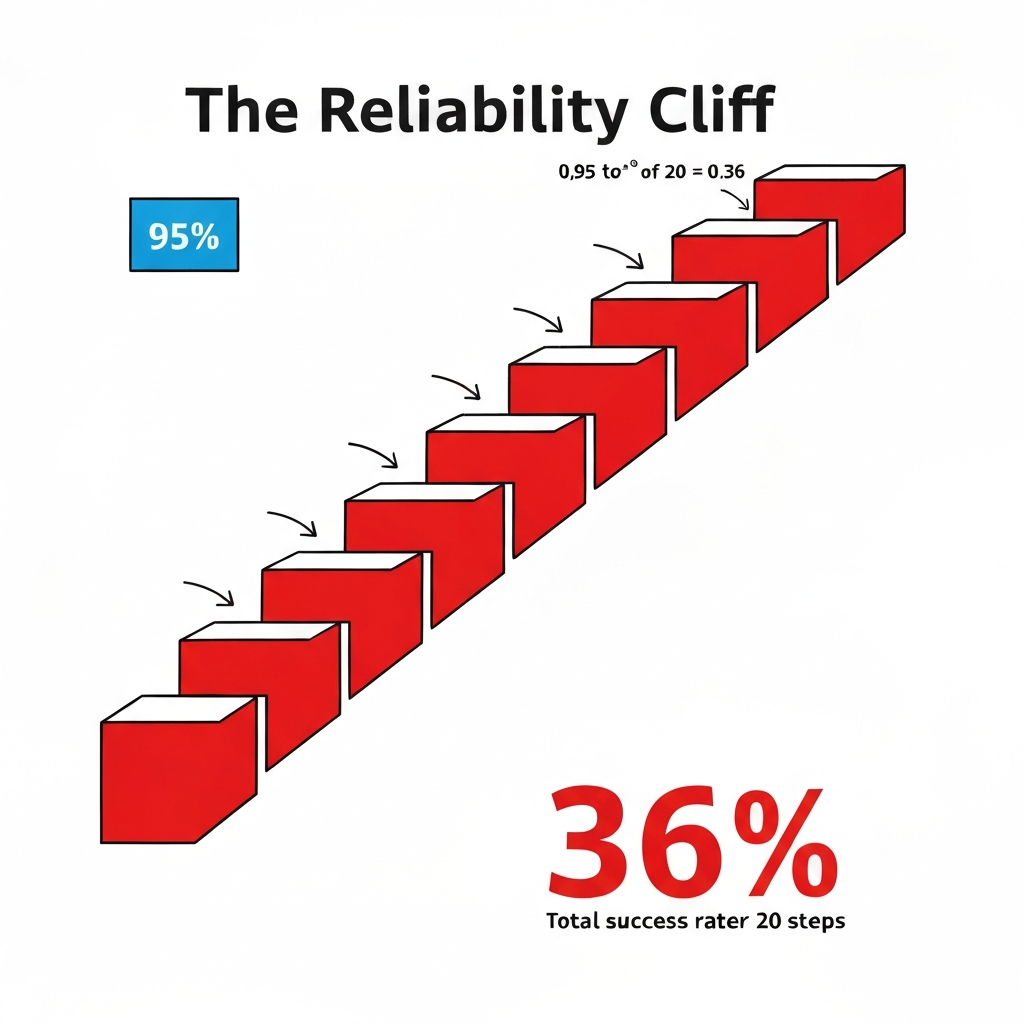

The math problem is real. LLMs are probabilistic. Business processes require deterministic outcomes. If each step in an agentic workflow achieves 95% reliability, a 20-step process has only a 36% chance of completing without error. Even at 98% per step: 67%. Enterprise finance and HR routinely involve 20+ steps requiring 99.9% reliability. To hit that across 20 steps, each step needs 99.995% accuracy. No LLM has achieved that. The best models on Vectara's hallucination leaderboard still clock in around 0.7% error rates - and that's on summarization tasks, not complex multi-system business processes. In payroll and tax filing, even 0.7% is not acceptable.

This is not a scaling problem. It is an architectural incompatibility.

My analogy might be wrong. I keep comparing SaaS-to-primitives with servers-to-cloud. But here's the honest problem with that: servers were undifferentiated commodity compute. A CPU cycle is a CPU cycle. SaaS applications are not commodity anything - they encode decades of business logic, workflow conventions, and institutional knowledge refined through millions of customer interactions. Salesforce is not a database with a UI. It is a business logic engine with compliance built in, an AppExchange ecosystem of 4,000+ integrations, and 30 years of accumulated process encoding. If this analogy is structurally wrong, my entire framework shifts. I still think it holds - because AI is making business logic itself codifiable and reproducible in ways that were impossible two years ago - but I'm less certain about this than I sound.

The consulting firms are failing. McKinsey's State of AI 2025: only 6% of organizations qualify as "high performers" attributing more than 5% of EBIT to AI. MIT's NANDA study found 95% of enterprise AI pilots failing - though that data predates the significant model capability jumps we saw in late 2025, and I'd bet those numbers look different by mid-2026. Even so, Gartner predicts over 40% of agentic AI projects will be canceled by end of 2027.

Enterprises don't buy on trajectory. Even if agents become reliable, Fortune 500 procurement cycles run 12-18 months. Change advisory boards exist to prevent exactly the kind of rapid transformation I'm describing. "Nobody ever got fired for buying Salesforce" is not just a joke - it is how enterprise risk committees actually think. This is a structural adoption barrier independent of technical capability, and it could add five years to any timeline.

Incumbents are fighting back - and they're good at it. Salesforce blocked Slack data from third-party AI platforms in May 2025 - updating API terms to prohibit indexing or storing messages. Enterprise AI search company Glean was forced to tell customers it could no longer access Slack data. SAP built zero-copy architectures specifically preventing data extraction. An agentic orchestration layer needs data access. When platforms control the data and the APIs, the orchestration layer exists at their mercy. And here's what I have to concede: Salesforce can be both genuinely threatened by this transformation AND successfully defend against it. Those aren't contradictory. Incumbents with data control, distribution networks, and compliance infrastructure can absorb the orchestration layer faster than startups can build the compliance and data layers from scratch.

The regulatory void is dangerous. DLA Piper: "The law of AI agents is undefined, and companies may find themselves strictly liable for all AI agent conduct, whether or not predicted or intended." The EU Product Liability Directive, effective December 2026, classifies AI software as a "product" subject to strict liability. Enterprise SaaS isn't just software - it's compliance infrastructure. Salesforce provides the framework for SOX compliance. Workday embeds employment law across hundreds of jurisdictions. SAP embeds tax regulations for dozens of countries. No orchestration startup can replicate that overnight.

Where the Bear Case Breaks Down

So why do I still believe this despite everything I just wrote?

Because every technology transition starts with terrible numbers and structural objections that look insurmountable - until they don't.

I lived through 2006, when people said cloud computing would never work because enterprises wouldn't trust someone else's servers. They measured adoption against rip-and-replace. The actual transformation happened through hybrid architectures over a decade. I am not arguing AI agents will replace Salesforce next year. Current goal completion rates on basic CRM tasks sit below 55%. Terrible. The trajectory bends toward the threshold. The question is timing, not direction.

I've built this myself. I created an agentic CRM for one of my companies. Agents research and score opportunities, determine next steps based on loaded prompts and guides. We've already exceeded what Salesforce offers out of the box. By late 2025, building agentic workflows that would have required custom code for every integration six months earlier could be assembled with off-the-shelf agent frameworks.

The question that keeps me up at night: if Salesforce is a UI with a database and you abstract away the UI, what is it? And why doesn't Microsoft just host it?

The investment signal is deafening. AI startups captured $211 billion in venture funding in 2025 - roughly half of all global VC, per Crunchbase. Microsoft now has 15 million paid Copilot seats, nearly doubling from mid-2025 - though still only 3.3% of their commercial base. Gartner predicts 40% of enterprise apps will feature AI agents by 2026, up from under 5%. Benioff set a target of one billion Agentforce agents by end of 2025. He missed. But the ambition tells you where incumbents themselves believe this is heading.

The incumbents' defense validates the direction. When Salesforce restricts Slack APIs to force AI functionality through Agentforce, they're confirming the value is in the orchestration layer. They want to own that layer themselves. The prisoner's dilemma is real: defend the legacy or cannibalize it. History says the cannibals win - but it's an open question whether incumbents or new entrants will be the ones holding the knife.

The Railroad Parallel

Before 1873, America invested billions in railroad infrastructure - roughly 20% of all U.S. capital. The Panic of 1873 wiped out over a hundred railroads. Half of all railroad bonds defaulted by 1879.

But farmers who used cheap transportation got decades of productivity gains. Infrastructure builders went bankrupt. Infrastructure users got rich.

Current SaaS companies are railroad operators. Agentic layer companies - if they solve the reliability problem - are the farmers.

Two Futures for the New Firm

I see two models emerging, and which one wins depends on a single variable: how fast AI abstracts away technical detail.

Model one: the meta-organization. Still an accounting firm. Still a marketing agency. Still a consultancy. But the people inside don't do the accounting, the marketing, or the consulting - they build and refine the agents that do. The accountants become agent trainers. The marketers become workflow designers. The domain expertise stays, but the actual execution is agentic. If AI tools become easy enough that domain experts can manage their own agentic workflows without touching code, this model scales fast and the humans focus on agent strategy, client relationships, and quality control.

Model two: the Palantir-lite. Small teams running AI-maintained orchestration for dozens of clients - monitoring how people use tools, detecting process changes, upgrading constantly. Each deployment continuously learning and adapting. Not glamorous. Not a platform play. But enormous aggregate value. This model wins if building reliable agentic orchestration remains technically demanding - if some level of knowledge about the underlying plumbing still matters.

My gut says we get both. Model one for simpler workflows within the next three years. Model two for complex, mission-critical processes where the reliability math still requires human engineering judgment. The implementation consulting industry either evolves into one of these or dies.

Where I Could Be Fundamentally Wrong

Three scenarios where this thesis collapses entirely, not just gets delayed.

Reliability never crosses the threshold. If the hallucination floor holds and compound error rates make multi-step business processes mathematically impossible for AI agents, SaaS stays the system of record AND the system of engagement. AI bolts on as a feature. This is the Salesforce bull case. 20% odds.

Incumbents absorb the orchestration layer. Salesforce, SAP, and Oracle build native agentic capabilities AND lock down APIs. Value shifts within existing platforms, not above them. The middleware pattern repeats exactly. 20% odds.

Regulatory capture kills it. Strict liability for AI agent errors means no startup can afford compliance. Only incumbents deploy agents at scale. 15% odds.

That leaves roughly 45% odds my thesis plays out - new firms building and maintaining agentic layers above commoditized primitives. Not a certainty. But better than a coin flip, and on a market transformation this large, that's a bet worth making.

Falsifiable Predictions

Track new company CRM adoption. I expect 20-30% declines in new Salesforce implementations by 2028. If not, I'm wrong.

Watch Google Vertex and Azure AI Foundry adoption. If enterprise workloads don't meaningfully migrate to cloud-hosted agentic environments by 2028, the thesis stalls.

Monitor Salesforce's API policy. If they keep restricting access and Agentforce achieves meaningful adoption, the incumbents-absorb scenario is winning.

The hardest test: if specialized agentic providers can't achieve 99% reliability in business-critical processes within four years, the mathematical barrier holds.

The Bottom Line

Everyone's debating whether AI will replace SaaS. Wrong question.

Who captures value when business applications become orchestrated primitives? My bet is on new entrants who solve reliability first - the next-gen systems integrators who figure out how to make agentic orchestration boring and dependable. But the cloud providers are the dark horse, and the incumbents have a real shot at absorbing this whole wave.

Eventually people won't be satisfied with the ERP-CRM bifurcation. They'll want everything in one agentic flow. Whether that runs on Agentforce or something built by a company that doesn't exist yet - that's the $5 trillion question.

Place your bets accordingly. I'm placing mine on the insurgents.