The Pattern You've Seen Before

Trump told us exactly what he's doing. Reporters asked about the carrier buildup on Friday, and he said: "You have to get in position. We have plenty of time. If you remember Venezuela, we waited around for a while."

Venezuela. The Ford carrier strike group, the largest Caribbean deployment since the Cuban Missile Crisis, the limited strikes on port infrastructure — and then a deal with Maduro. The pattern: escalate hard, build overwhelming force, negotiate from the implied threat, take the deal.

Now he's running the same playbook against Iran, with the same beats. Military buildup. Public threats of "violence." Simultaneous back-channel negotiations (Oman, February 6). And the explicit signal that this is about pressure, not launch orders: "I insisted that negotiations with Iran continue to see whether or not a Deal can be consummated. If it can, I let the Prime Minister know that will be a preference."

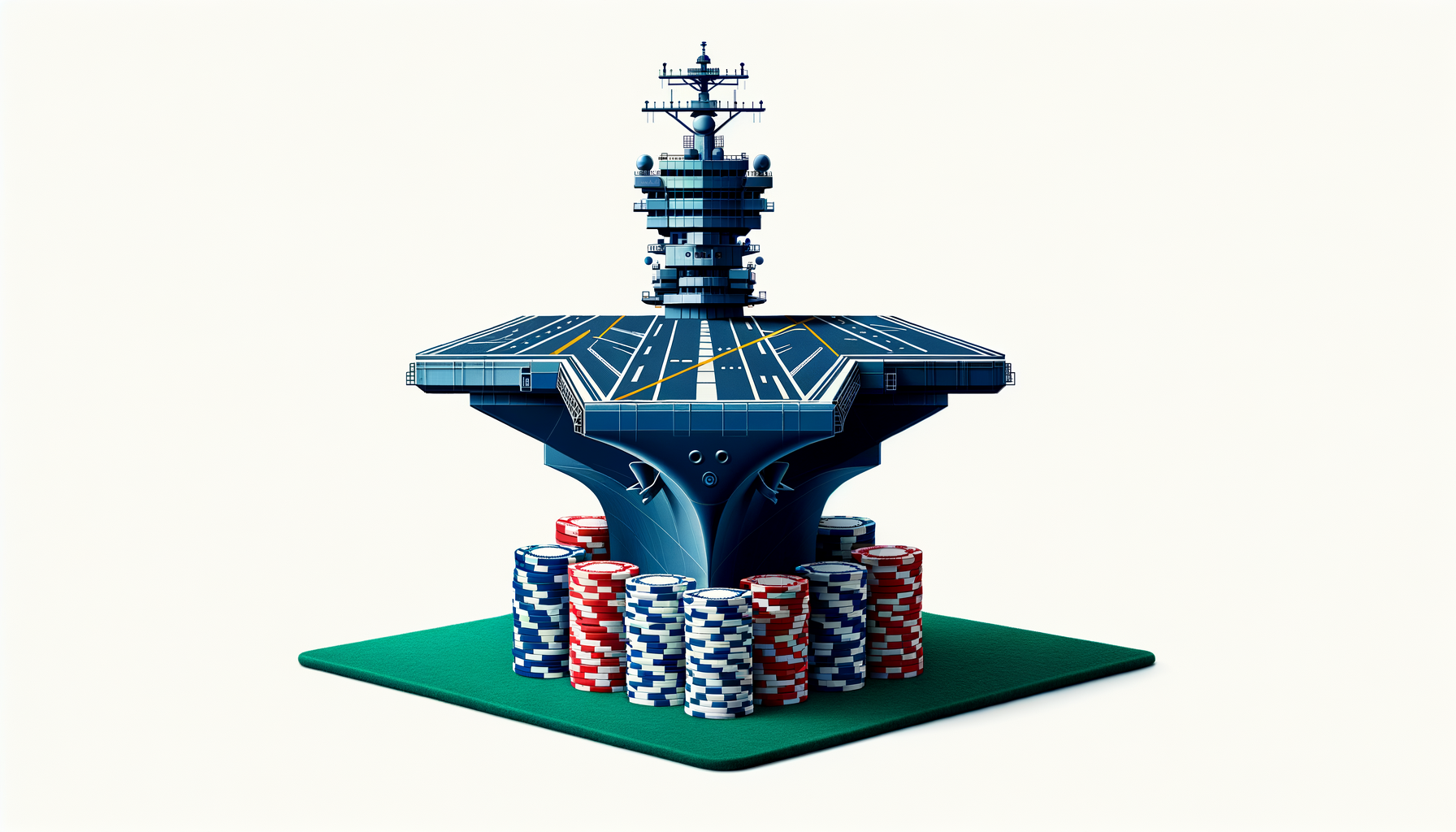

The carriers are chips on the table, not bullets in a chamber. But here's the problem: chips only work if the other player believes you'll cash them in.

What the Numbers Actually Say

Iran's nuclear breakout time — the time to produce enough weapons-grade uranium for a bomb — is less than one week. Not months. Not years. Days. They have 275 kilograms of 60% enriched uranium, enough for roughly ten nuclear devices. The JCPOA sunset provisions that constrained enrichment capacity expired in January 2026. Iran is rebuilding the sites the US bombed eight months ago.

Operation Midnight Hammer — the June 2025 strikes on Fordow, Natanz, and Isfahan — was supposed to set the program back one to two years. A leaked US intelligence assessment said it was more like months. Iran's centrifuges are spinning while diplomats talk in Oman.

The domestic picture is equally stark. Protests swept all 31 provinces in December and January. The regime's January crackdown was among the deadliest in the Islamic Republic's history — Amnesty International called January 2026 the worst period of repression in Iran in decades, and multiple credible estimates put the death toll in the tens of thousands. The currency has collapsed more than 60% over the past year. Inflation runs above 40%. US intelligence officers told Axios they were "reassessing" whether the protests could destabilize the regime — the first time that assessment has shifted in years.

Prediction markets price the situation with unusual precision: 23% chance of a US strike by end of February. 41% by end of March. 83% by June 30 — with $22 million in volume behind that number. Kalshi puts Khamenei out as Supreme Leader by year-end at 66%.

The Scope Gap That Tells the Real Story

The Oman talks on February 6 ended exactly as structural analysis would predict: no deal, both sides claiming progress, no shift in position.

The reason is the scope gap, and it's the most important thing happening in this negotiation.

Iran will discuss its nuclear program. Period. Enrichment, inspections, constraints — maybe. Ballistic missiles? Off the table. Proxy networks? Not negotiable. Iran's foreign minister called it "non-negotiable" in a press conference the day after talks concluded.

Trump wants a comprehensive deal: nuclear, missiles, proxies, human rights. He called it a "no-brainer."

The gap looks like a dealbreaker. It might be a feature.

For Iran, accepting broad talks signals weakness to the IRGC hardliners who profit from sanctions (smuggling revenue is an institutional interest, not an ideological one). For Trump, demanding broad talks sets a bar Iran can't meet, preserving the option to blame Tehran for failure and justify escalation. Both sides need the gap to manage their domestic audiences while the real negotiation happens underneath.

The question isn't whether they can bridge the scope gap. It's whether they want to.

The Three-Body Problem

The carrier deployment makes sense as US-Iran bilateral pressure. But this isn't a bilateral game. Netanyahu flew to Washington on February 10 to present his "principles" for Iran talks. He wants enrichment eliminated entirely, ballistic missiles restricted, and Iran's regional proxy support ended. He told Trump in December he was considering "round 2" strikes.

Netanyahu's position creates a structural problem that no amount of diplomatic skill can resolve: the US and Iran can reach a deal, but Israel has veto power through unilateral action. Any agreement Israel considers insufficient — and Netanyahu has defined "sufficient" at the maximalist end of the spectrum — risks a unilateral Israeli strike that collapses the deal and forces Washington to choose between its ally and its agreement.

This is exactly what happened with the JCPOA. Netanyahu's 2018 televised presentation of Mossad's stolen nuclear archive — 55,000 pages hauled out of a Tehran warehouse — was designed to give Trump the political cover to withdraw. It worked. The deal didn't survive. The structural instability isn't about the specific terms. It's about the three-player geometry: the US wants a deal, Iran wants survival, and Israel wants permanent elimination of the threat. Those three objectives have no common solution set.

After his meeting with Netanyahu, Trump posted on social media that he "insisted that negotiations with Iran continue." Read that carefully. He insisted — to Netanyahu. That's a signal aimed at one audience: the Israeli prime minister who wants military action, being told to wait.

The Pacific Price Tag

Here's what the Iran story costs on the other side of the world: the USS Abraham Lincoln was pulled from the South China Sea. It's the fifth time in two years a carrier has been redeployed from Asia to the Middle East.

The math is unforgiving. The US has 11 carrier strike groups. Maintenance cycles, training requirements, and transit times mean only three to four are deployable at any given time. Two in the Middle East leaves one or two for the entire Western Pacific — where China is watching.

On January 29, Iran, China, and Russia signed a trilateral strategic pact. The timing was not coincidental. Every carrier that steams toward the Arabian Sea is one fewer contesting Beijing's claims in the South China Sea. China's optimal outcome isn't an Iran deal or an Iran war. It's permanent US-Iran tension that never resolves, permanently siphoning American naval power from the Pacific.

The Abraham Lincoln's departure ended a 20-day carrier gap in the Middle East — the first such absence since October 2023. It created a corresponding gap in the Pacific that hasn't been discussed with the same urgency.

What This Actually Is

I've been watching carrier deployments as market signals for years. This one follows the oldest pattern in American foreign policy: coercive diplomacy. Threaten force to extract concessions without actually fighting.

The textbook case is the Cuban Missile Crisis — naval blockade, back-channel negotiation, credible threat, face-saving exit. Kennedy deployed overwhelming force. Khrushchev calculated the risk and blinked. But Kennedy also offered a secret concession (removing Jupiter missiles from Turkey) that gave Khrushchev the off-ramp.

The question the second carrier raises: what's the off-ramp?

Sanctions relief is the obvious answer. Iran's economy is in freefall, and a regime that just killed thousands of its own citizens needs something to offer its population beyond revolutionary slogans. But sanctions relief for a nuclear freeze doesn't address missiles or proxies — the issues Trump has said must be part of any deal.

There's a deeper problem. Coercive diplomacy has a credibility ratchet. The Venezuela buildup was novel and produced a deal. The June 2025 carrier buildup produced actual strikes — and those strikes underperformed. Now the third iteration requires two carriers to generate the same level of perceived seriousness. What does the fourth require? The marginal credibility of each deployment is declining. Iran has direct experience of surviving an American attack. The fear of the unknown was more powerful than the known reality of Midnight Hammer.

Richard Nixon tried the same pattern in 1969. Operation Giant Lance sent nuclear-armed B-52s toward the Soviet border for 18 hours to pressure Moscow on Vietnam. The Soviets detected the flights but couldn't figure out what the signal meant — they initially thought it was about their border conflict with China, not Vietnam. The war continued for six more years.

Academic studies of "prominent madmen" in international relations — Nixon, Khrushchev, Trump, Saddam, Gaddafi — conclude that all of them failed to win coercive disputes. The pattern looks powerful from the inside. From the outside, it produces confusion, hedging, and opponents who build their own insurance policies. For Iran, that insurance policy is a nuclear weapon.

Three Things to Watch

1. The scope narrowing (March 2026): If the second round of talks shifts from "comprehensive vs. nuclear-only" to detailed enrichment caps and inspection frameworks, the deal track is real. If the scope argument persists, it's theater — both sides using the disagreement as cover for their real objectives (Iran: time; US: justification for escalation).

2. The carrier deployment order (Next 2 weeks): The Bush hasn't deployed yet. If it deploys but parks in the Eastern Mediterranean rather than the Arabian Sea, it's positioning, not action. If it joins the Lincoln in close proximity to Iran, the threat level escalates materially. Watch the geography, not the announcement.

3. The Khamenei succession signal (2026): The 86-year-old Supreme Leader's health and the IRGC's positioning for succession may matter more than any diplomatic signal. A regime preparing for leadership transition has different risk calculations than one with a settled power structure. If Khamenei's health deteriorates, Iran's nuclear timeline accelerates — because the weapon becomes the successor's insurance policy, not just the regime's.

Here's where I come down: the carriers will probably not fire a shot. Trump wants a deal, and the military positioning is designed to get one. I think we see a narrow nuclear agreement — enrichment caps and inspections in exchange for sanctions relief — by late Q2 2026, with missiles and proxies kicked down the road. Netanyahu will protest publicly and quietly accept it, because the alternative (another round of strikes that only delays the program by months) is worse.

But I'm watching the credibility ratchet more than the diplomacy. Each time this playbook gets run, it works a little less. Iran survived Midnight Hammer. They know what American strikes actually do, and it's less than advertised. The playbook is familiar. The opponent has already survived it once. And a survivor makes different calculations than someone facing the unknown.